All Categories

Featured

Table of Contents

Another opportunity is if the deceased had a present life insurance policy plan. In such cases, the designated recipient might obtain the life insurance policy proceeds and utilize all or a portion of it to repay the home loan, permitting them to remain in the home. insurance to cover loan. For individuals who have a reverse mortgage, which allows individuals aged 55 and above to obtain a mortgage loan based on their home equity, the finance rate of interest builds up in time

Throughout the residency in the home, no settlements are needed. It is necessary for people to thoroughly intend and take into consideration these variables when it comes to mortgages in Canada and their effect on the estate and successors. Looking for guidance from lawful and economic experts can aid ensure a smooth shift and correct handling of the home mortgage after the homeowner's passing.

It is essential to comprehend the readily available options to make sure the home loan is effectively taken care of. After the fatality of a house owner, there are a number of alternatives for home loan payment that rely on different factors, consisting of the regards to the mortgage, the deceased's estate planning, and the wishes of the successors. Below are some common options:: If several beneficiaries wish to think the home loan, they can become co-borrowers and continue making the home mortgage settlements.

This alternative can give a tidy resolution to the home mortgage and disperse the continuing to be funds among the heirs.: If the deceased had an existing life insurance policy plan, the marked recipient might obtain the life insurance policy proceeds and utilize them to pay off the mortgage (home buyers protection insurance reviews). This can allow the recipient to continue to be in the home without the problem of the home loan

If nobody remains to make mortgage payments after the homeowner's fatality, the home loan lender has the right to foreclose on the home. The influence of foreclosure can vary depending on the circumstance. If a successor is called but does not market your home or make the mortgage repayments, the home mortgage servicer could launch a transfer of ownership, and the repossession could significantly damage the non-paying beneficiary's credit.In instances where a homeowner passes away without a will or count on, the courts will certainly assign an administrator of the estate, generally a close living loved one, to distribute the properties and liabilities.

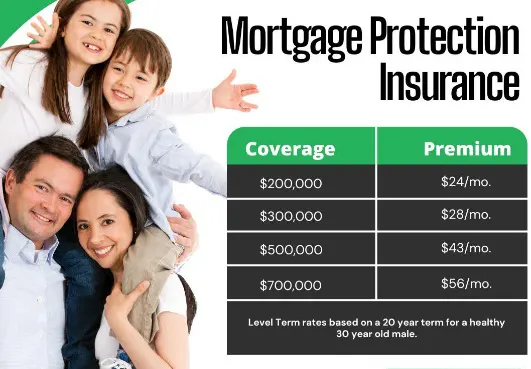

Mortgage Life Insurance Comparison

Home loan defense insurance coverage (MPI) is a form of life insurance coverage that is particularly designed for people who want to make sure their home mortgage is paid if they pass away or end up being handicapped. Occasionally this kind of policy is called home mortgage settlement protection insurance.

When a financial institution owns the large majority of your home, they are accountable if something happens to you and you can no more make payments. PMI covers their threat in case of a foreclosure on your home (insurance that pays mortgage in case of death). On the other hand, MPI covers your risk in the occasion you can no more make payments on your home

The amount of MPI you need will vary depending on your one-of-a-kind situation. Some variables you must take into account when taking into consideration MPI are: Your age Your health Your economic scenario and sources Various other types of insurance coverage that you have Some individuals may believe that if they currently own $200,000 on their mortgage that they must acquire a $200,000 MPI plan.

Mortgage Insurance Layoff Protection

The inquiries people have regarding whether or not MPI is worth it or not are the same inquiries they have about buying other kinds of insurance policy in basic. For the majority of people, a home is our single largest debt.

The combination of anxiety, sorrow and altering family dynamics can create even the ideal intentioned people to make expensive mistakes. new mortgage insurance companies. MPI fixes that issue. The value of the MPI plan is directly linked to the equilibrium of your home loan, and insurance coverage profits are paid straight to the financial institution to deal with the remaining equilibrium

And the largest and most difficult economic issue encountering the making it through member of the family is dealt with instantaneously. If you have wellness concerns that have or will certainly create troubles for you being authorized for normal life insurance policy, such as term or whole life, MPI might be an exceptional option for you. Generally, home loan security insurance coverage do not call for medical examinations.

Historically, the quantity of insurance policy coverage on MPI policies dropped as the equilibrium on a mortgage was minimized. Today, the insurance coverage on the majority of MPI policies will certainly continue to be at the same level you bought. As an example, if your original mortgage was $150,000 and you purchased $150,000 of mortgage security life insurance, your beneficiaries will now get $150,000 regardless of exactly how a lot you owe on your home mortgage - home loan and insurance.

If you intend to settle your home loan early, some insurance provider will enable you to transform your MPI plan to an additional kind of life insurance policy. This is just one of the concerns you might desire to attend to up front if you are thinking about settling your home early. Expenses for home loan security insurance policy will certainly differ based upon a variety of points.

Policy Mortgage

Another variable that will certainly affect the costs quantity is if you acquire an MPI policy that offers coverage for both you and your partner, offering benefits when either one of you passes away or becomes handicapped. Realize that some business might require your policy to be editioned if you re-finance your home, however that's typically just the case if you got a policy that pays out only the balance left on your home mortgage.

What it covers is extremely slim and plainly specified, depending on the alternatives you pick for your certain plan. If you die, your home mortgage is paid off.

For home mortgage defense insurance coverage, these forms of added coverage are included on to policies and are known as living benefit bikers. They allow plan owners to use their home loan defense benefits without diing. Below's how living benefit cyclists can make a home mortgage security plan better. In cases of, most insurer have this as a totally free benefit.

For instances of, this is normally now a free living advantage supplied by many business, however each company specifies advantage payouts differently. This covers ailments such as cancer cells, kidney failing, cardiac arrest, strokes, mind damages and others. very payment protection insurance. Business normally pay out in a swelling sum relying on the insured's age and extent of the ailment

Sometimes, if you utilize 100% of the permitted funds, after that you used 100% of the policy survivor benefit worth. Unlike a lot of life insurance policy plans, purchasing MPI does not require a medical examination a lot of the moment. It is offered without underwriting. This indicates if you can not get term life insurance policy due to an ailment, an assured issue home mortgage security insurance plan can be your best bet.

When possible, these need to be individuals you understand and depend on that will certainly provide you the most effective suggestions for your situation. No matter who you choose to discover a plan with, you should always shop around, due to the fact that you do have options - mortgage protection plan. Sometimes, accidental fatality insurance is a better fit. If you do not certify for term life insurance policy, then unintended fatality insurance coverage might make even more feeling due to the fact that it's assurance issue and indicates you will not undergo clinical exams or underwriting.

Mortgage Insurance Agency Ltd

Make sure it covers all costs related to your mortgage, consisting of interest and payments. Ask how swiftly the plan will certainly be paid out if and when the main income earner passes away.

Latest Posts

Canadian Final Expense Plan

Final Expense Protect Life Insurance

Funeral Advantage Rates