All Categories

Featured

Table of Contents

- – What is the Definition of 30-year Level Term L...

- – What is 10-year Level Term Life Insurance? Key...

- – What is Life Insurance Level Term? Your Guide...

- – What is Term Life Insurance For Seniors? A Si...

- – What is Guaranteed Level Term Life Insurance...

- – What is Level Premium Term Life Insurance? P...

If George is detected with a terminal disease throughout the first policy term, he possibly will not be eligible to restore the policy when it expires. Some policies provide ensured re-insurability (without evidence of insurability), however such features come with a greater cost. There are a number of kinds of term life insurance policy.

Many term life insurance has a degree costs, and it's the kind we've been referring to in many of this post.

Term life insurance is appealing to young people with children. Parents can obtain significant protection for an inexpensive, and if the insured passes away while the plan is in impact, the family members can rely upon the survivor benefit to change lost revenue. These policies are also fit for people with growing families.

What is the Definition of 30-year Level Term Life Insurance?

Term life policies are suitable for individuals who want substantial insurance coverage at a reduced price. Individuals who possess entire life insurance pay much more in premiums for much less coverage yet have the safety of understanding they are shielded for life.

The conversion cyclist ought to allow you to transform to any kind of long-term plan the insurer provides without limitations. The primary attributes of the biker are preserving the initial health score of the term plan upon conversion (also if you later on have wellness issues or end up being uninsurable) and determining when and just how much of the coverage to convert.

Naturally, total costs will increase significantly because entire life insurance is a lot more expensive than term life insurance. The advantage is the assured authorization without a medical examination. Clinical conditions that establish throughout the term life period can not create costs to be raised. The business may need restricted or full underwriting if you want to include added cyclists to the new policy, such as a lasting treatment rider.

What is 10-year Level Term Life Insurance? Key Information for Policyholders

Term life insurance policy is a reasonably low-cost means to give a round figure to your dependents if something takes place to you. It can be a good choice if you are young and healthy and support a household. Whole life insurance policy includes significantly higher month-to-month premiums. It is implied to supply coverage for as long as you live.

Insurance coverage companies set a maximum age limitation for term life insurance plans. The premium also increases with age, so a person matured 60 or 70 will certainly pay considerably even more than someone decades younger.

Term life is rather comparable to car insurance coverage. It's statistically not likely that you'll need it, and the premiums are cash down the drain if you do not. However if the most awful takes place, your family will receive the advantages (Term life insurance with level premiums).

What is Life Insurance Level Term? Your Guide to the Basics?

Essentially, there are two kinds of life insurance policy plans - either term or permanent strategies or some mix of the 2. Life insurance companies supply various forms of term plans and typical life policies along with "rate of interest delicate" products which have come to be more prevalent considering that the 1980's.

Term insurance coverage provides security for a specific amount of time. This period could be as brief as one year or offer insurance coverage for a certain variety of years such as 5, 10, 20 years or to a defined age such as 80 or sometimes approximately the earliest age in the life insurance policy mortality.

What is Term Life Insurance For Seniors? A Simple Explanation?

Currently term insurance rates are really affordable and among the least expensive historically experienced. It must be noted that it is a commonly held idea that term insurance policy is the least expensive pure life insurance policy coverage offered. One requires to review the policy terms very carefully to decide which term life options appropriate to satisfy your specific circumstances.

With each brand-new term the premium is raised. The right to renew the policy without evidence of insurability is an essential benefit to you. Or else, the risk you take is that your health might weaken and you may be not able to obtain a policy at the very same prices and even whatsoever, leaving you and your beneficiaries without protection.

The size of the conversion period will certainly differ depending on the type of term policy purchased. The premium rate you pay on conversion is usually based on your "existing achieved age", which is your age on the conversion day.

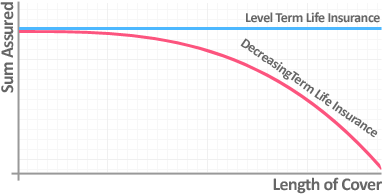

Under a level term policy the face amount of the policy remains the same for the whole period. Typically such policies are sold as mortgage defense with the quantity of insurance coverage decreasing as the equilibrium of the mortgage decreases.

Generally, insurance providers have not had the right to alter costs after the plan is sold. Because such policies might proceed for several years, insurance firms must use conservative death, rate of interest and expenditure price price quotes in the costs estimation. Flexible premium insurance, nonetheless, permits insurers to offer insurance coverage at reduced "existing" premiums based upon much less traditional presumptions with the right to change these costs in the future.

What is Guaranteed Level Term Life Insurance? Your Essential Questions Answered?

While term insurance coverage is created to provide defense for a defined amount of time, irreversible insurance policy is designed to provide insurance coverage for your whole life time. To maintain the costs rate degree, the costs at the younger ages goes beyond the actual cost of protection. This additional costs develops a reserve (cash money value) which aids pay for the policy in later years as the expense of defense increases over the costs.

Under some plans, premiums are required to be paid for a set variety of years (Guaranteed level term life insurance). Under other policies, costs are paid throughout the insurance policy holder's lifetime. The insurance provider invests the excess costs bucks This kind of policy, which is in some cases called cash value life insurance policy, produces a cost savings element. Cash money values are essential to a long-term life insurance coverage plan.

Often, there is no relationship between the size of the cash money worth and the costs paid. It is the money value of the plan that can be accessed while the insurance policy holder is active. The Commissioners 1980 Criterion Ordinary Death Table (CSO) is the existing table made use of in determining minimal nonforfeiture values and plan books for common life insurance policy plans.

What is Level Premium Term Life Insurance? Pros, Cons, and Features

Several irreversible plans will consist of stipulations, which define these tax needs. Standard whole life plans are based upon long-term estimates of expenditure, passion and mortality.

Table of Contents

- – What is the Definition of 30-year Level Term L...

- – What is 10-year Level Term Life Insurance? Key...

- – What is Life Insurance Level Term? Your Guide...

- – What is Term Life Insurance For Seniors? A Si...

- – What is Guaranteed Level Term Life Insurance...

- – What is Level Premium Term Life Insurance? P...

Latest Posts

Canadian Final Expense Plan

Final Expense Protect Life Insurance

Funeral Advantage Rates

More

Latest Posts

Canadian Final Expense Plan

Final Expense Protect Life Insurance

Funeral Advantage Rates