All Categories

Featured

Table of Contents

If you select level term life insurance policy, you can allocate your costs due to the fact that they'll stay the exact same throughout your term. And also, you'll know precisely just how much of a fatality benefit your recipients will certainly receive if you pass away, as this amount won't transform either. The rates for level term life insurance policy will certainly depend on numerous variables, like your age, health standing, and the insurance coverage firm you pick.

As soon as you go through the application and medical examination, the life insurance policy firm will certainly review your application. Upon approval, you can pay your first premium and authorize any type of appropriate documentation to guarantee you're covered.

You can pick a 10, 20, or 30 year term and appreciate the included tranquility of mind you are worthy of. Functioning with a representative can help you locate a policy that works ideal for your needs.

As you search for methods to safeguard your financial future, you have actually likely found a wide range of life insurance policy alternatives. direct term life insurance meaning. Picking the ideal coverage is a large choice. You wish to discover something that will certainly help sustain your loved ones or the reasons important to you if something takes place to you

Numerous individuals lean toward term life insurance policy for its simpleness and cost-effectiveness. Level term insurance coverage, nevertheless, is a kind of term life insurance policy that has regular repayments and an unchanging.

Innovative Voluntary Term Life Insurance

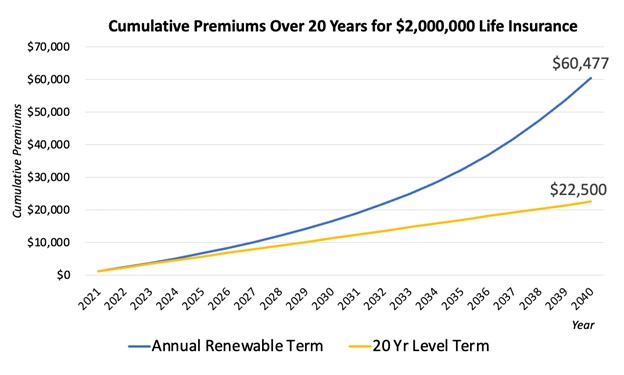

Level term life insurance policy is a part of It's called "level" because your premiums and the advantage to be paid to your enjoyed ones continue to be the exact same throughout the agreement. You will not see any kind of modifications in cost or be left questioning its value. Some contracts, such as annually eco-friendly term, may be structured with premiums that boost in time as the insured ages.

Fixed fatality advantage. This is additionally established at the start, so you can know exactly what fatality benefit amount your can expect when you pass away, as long as you're covered and up-to-date on costs.

This commonly between 10 and three decades. You accept a set costs and survivor benefit throughout of the term. If you pass away while covered, your survivor benefit will certainly be paid to liked ones (as long as your costs are up to day). Your beneficiaries will recognize ahead of time just how much they'll get, which can aid for intending purposes and bring them some economic security.

You might have the choice to for an additional term or, most likely, restore it year to year. If your contract has a guaranteed renewability stipulation, you may not require to have a brand-new medical examination to keep your insurance coverage going. Your costs are likely to increase due to the fact that they'll be based on your age at revival time.

With this option, you can that will certainly last the rest of your life. In this instance, once again, you may not need to have any type of new medical exams, however premiums likely will rise as a result of your age and new insurance coverage. guaranteed issue term life insurance. Different business offer various alternatives for conversion, be certain to recognize your selections prior to taking this step

Effective Term Life Insurance For Couples

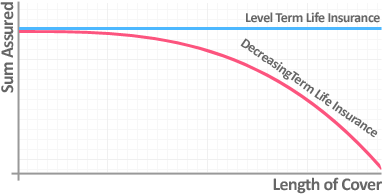

Many term life insurance policy is level term for the period of the agreement duration, but not all. With lowering term life insurance policy, your death benefit goes down over time (this kind is often taken out to especially cover a long-lasting financial obligation you're paying off).

And if you're set up for eco-friendly term life, then your premium likely will increase each year. If you're discovering term life insurance and wish to make sure simple and foreseeable financial protection for your family members, level term might be something to think about. However, as with any type of kind of coverage, it may have some restrictions that don't fulfill your needs.

Expert What Is Decreasing Term Life Insurance

Usually, term life insurance is more budget friendly than long-term protection, so it's an affordable method to protect monetary defense. Flexibility. At the end of your agreement's term, you have multiple choices to proceed or carry on from insurance coverage, often without needing a medical exam. If your budget or protection needs adjustment, survivor benefit can be minimized in time and outcome in a lower premium.

As with various other kinds of term life insurance coverage, as soon as the agreement finishes, you'll likely pay greater premiums for coverage due to the fact that it will recalculate at your current age and health and wellness. Fixed coverage. Degree term uses predictability. Nonetheless, if your economic scenario adjustments, you might not have the necessary coverage and might have to acquire additional insurance coverage.

That doesn't suggest it's a fit for everybody. As you're buying life insurance policy, here are a couple of key elements to think about: Budget. Among the advantages of level term insurance coverage is you know the expense and the fatality advantage upfront, making it easier to without bothering with rises gradually.

Typically, with life insurance policy, the much healthier and younger you are, the extra economical the protection. If you're young and healthy, it may be an attractive option to lock in low premiums currently. If you have a young family members, for instance, degree term can aid provide economic support throughout vital years without paying for insurance coverage longer than required.

1 All bikers are subject to the terms and conditions of the motorcyclist. Some states might vary the terms and conditions.

2 A conversion credit history is not offered for TermOne policies. 3 See Term Conversions area of the Term Collection 160 Product Guide for just how the term conversion credit history is figured out. A conversion credit is not readily available if costs or costs for the new policy will be forgoed under the terms of a cyclist supplying handicap waiver advantages.

Affordable Joint Term Life Insurance

Plans converted within the initial policy year will certainly receive a prorated conversion credit score subject to terms of the policy. 4 After 5 years, we book the right to limit the long-term product provided. Term Series items are released by Equitable Financial Life Insurance Business (Equitable Financial) (NY, NY) and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Policy Agency of The Golden State, LLC in CA; Equitable Network Insurance Policy Company of Utah in UT; and Equitable Network of Puerto Rico, Inc. Term Life Insurance is a type of life insurance coverage plan that covers the insurance policy holder for a certain amount of time, which is known as the term. The term sizes vary according to what the specific picks. Terms normally vary from 10 to three decades and rise in 5-year increments, providing degree term insurance coverage.

Latest Posts

Reputable What Is Level Term Life Insurance

Premium Guaranteed Issue Term Life Insurance

Irish Life Mortgage Life Insurance